- Reported massacre at hospital in Sudan’s El Fasher leaves 460 dead |

- DSE to complete IPO process within 6 months: MD |

- Prof Yunus asks for simplifying reform report for people |

- Forces from inside-outside may work to thwart polls: Prof Yunus |

- NCC for referendum, after July Charter order promulgation |

Adaptation Finance Shortfalls Leave Developing Countries Vulnerable

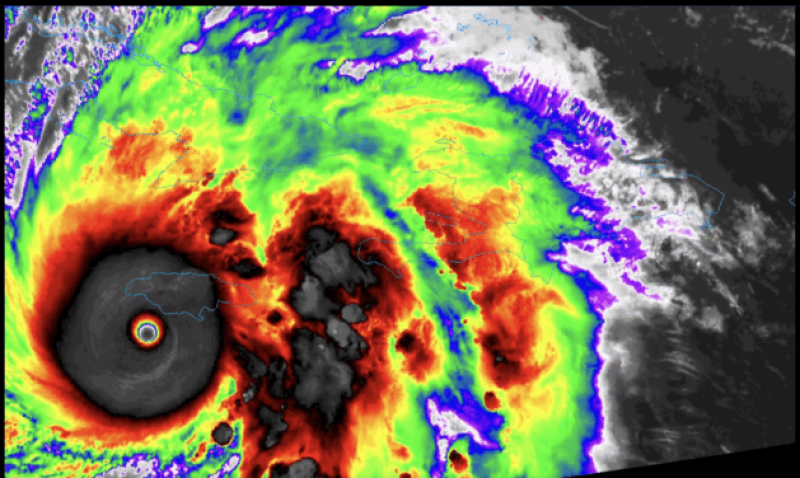

Jamaica in the eye of Hurricane Melissa, the strongest tropical cyclone on record.

Hurricane Melissa made landfall in Jamaica yesterday — the strongest hurricane to strike the island since 1851 — displacing tens of thousands of people and causing widespread damage to infrastructure. The storm, slightly weakened but still devastating, reached Cuba today, highlighting the urgent need for climate adaptation funding as reported in UNEP’s Adaptation Gap Report 2025: Running on Empty.

The report estimates that developing countries will require between USD 310 billion and USD 365 billion per year by 2035 to adapt to climate impacts. However, international public adaptation finance from developed to developing countries fell from USD 28 billion in 2022 to USD 26 billion in 2023, with data for 2024 and 2025 not yet available.

“This leaves an adaptation finance gap of USD 284–339 billion per year — 12 to 14 times current flows,” the report warns, released ahead of COP30 in Belém, Brazil.

Adaptation finance is crucial for countries and communities coping with climate impacts. “Climate impacts are accelerating. Yet adaptation finance is not keeping pace, leaving the world’s most vulnerable exposed to rising seas, deadly storms, and searing heat,” said UN Secretary-General António Guterres. “Adaptation is not a cost — it is a lifeline. Closing the adaptation gap is how we protect lives, deliver climate justice, and build a safer, more sustainable world. Let us not waste another moment.”

The report points out that investments in climate action far outweigh the costs of inaction. For example:

Every USD 1 spent on coastal protection avoids USD 14 in damages.

Urban nature-based solutions can reduce ambient temperatures by over 1°C on average.

Health-related capacity-building programs can reduce heat stress symptoms.

“Every person on this planet is living with the impacts of climate change: wildfires, heatwaves, desertification, floods, rising costs, and more,” said Inger Andersen, Executive Director of UNEP. “As action to cut greenhouse gas emissions continues to lag, these impacts will only worsen, harming more people and causing significant economic damage.”

Key findings from the report include:

Developing countries’ adaptation finance needs by 2035 are at least 12 times current international public flows.

The Glasgow Climate Pact goal of doubling the 2019 USD 40 billion pledge will be missed if current trends continue.

The new collective quantified goal for climate finance (NCQG) is insufficient to meet adaptation needs by 2035.

Evidence of improving adaptation planning exists but remains limited.

The Brazilian COP30 Presidency has called for a global effort to implement ambitious climate action, including bridging the finance gap and increasing contributions from both public and private sources.

Andersen highlighted the vulnerability of small island developing states like Jamaica, stating, “Those exposed to high winds, located near the ocean, or densely populated are the most at risk. Some are losing territory due to sea level rise, others are repeatedly hit by storms.”

While the Baku to Belém Roadmap aims to mobilise USD 1.3 trillion by 2035, the report cautions that care must be taken to avoid increasing the debt burdens of developing countries. Grants, concessional finance, and non-debt instruments are essential to ensure adaptation investments are sustainable.

Private sector contributions are also critical. Private flows, currently estimated at USD 5 billion per year, could reach USD 50 billion with targeted policy action and blended finance solutions, alongside concessionary public finance to de-risk investments.